Guarantees

Helping you with successful & safe transactions

A guarantee is an efficient solution FNB customers can use to enable trust between two parties in a transaction. The guarantee replaces the need for one party to provide another form of security such as cash.

Needs minimal administration

A guarantee issued to a beneficiary in South Africa is referred to as a Local Guarantee.

The benefits

Form of security

It replaces the need to provide other forms of security (such as a cash deposit), as the beneficiary knows they will be paid.

Investment growth

The security (such as a cash deposit) can be invested in an interest-bearing account.

Business growth

As the beneficiary relies on the guarantee, the transaction can proceed.

Business intent

Indicates the business standing of the Applicant as FNB is willing to underwrite their obligations.

Minimal admin

It removes the admin burden of getting the beneficiary to return security that has been provided.

Parties involved

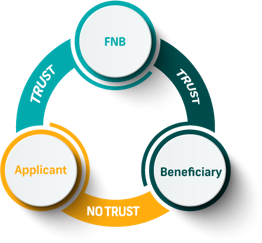

Aimed at building trust

As a minimum, the following parties are involved

Beneficiary

The party who relies on the guarantee as security against the risk of non-performance/default by the applicant

Applicant

The party applying for the issuance of a guarantee to cover the risk of their non-performance/default

Guarantor

The party who issues a guarantee on behalf of the applicant

Local and foreign guarantees